Helium: high-tech, high-value applications

Helium market

Helium’s unique combination of physical and chemical characteristics make it a high-value commodity with numerous applications in crucial fields of industry and technology.

Characteristics of helium

- Inert

- Lighter than air

- Small atomic radius

- Low solubility

- Lowest boiling point of any element (-268.9˚C)

- Non-toxic

- Non-radioactive

- Odourless

- Colourless

- Low reactivity

Helium is produced by the slow radioactive decay of elements within ancient continental crust and released when this ancient crust is broken up by powerful plate tectonic forces, as occurs within the East African Rift valley. There is no way of manufacturing helium artificially, nor can it be commercially extracted from the atmosphere.

Drilling for helium is nearly identical to the process of drilling for natural gas, allowing for the transfer of knowledge and technology from the oil and gas sector. As a high-value product, liquid helium can be transported via ISO containers mounted onto trucks with no pipelines needed.

Uses of helium

Helium is a vital resource across the technology, science, medicine, and manufacturing industries. It is widely regarded as the unsung commodity of the digital revolution given its importance in a range of high-tech manufacturing applications.

Helium demand

Global demand is estimated to be around 6 billion cubic feet (Bcf) per annum, with China alone importing 1 Bcf a year. Annual demand expected to increase from 6.0Bcf to 8.5Bcf by 2030.

Medical

- MRI scanners

- Assisted breathing

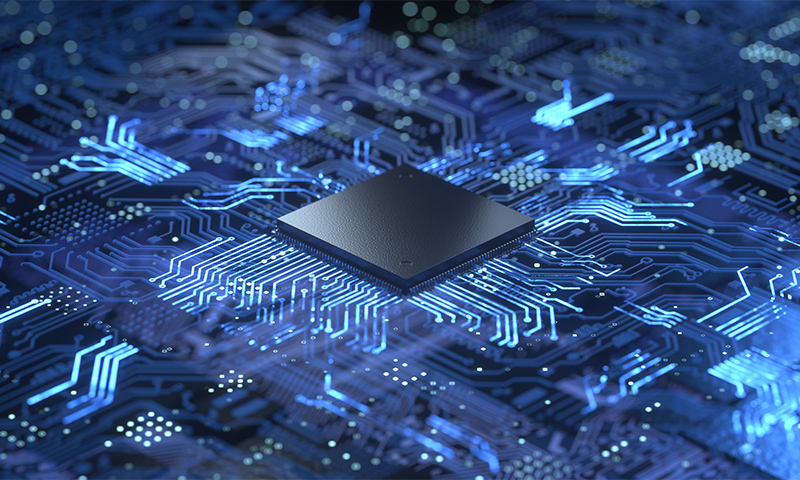

Electronics

- Semi-conductors

- Fibre-optics

Energy

- Nuclear fission

- Nuclear fusion

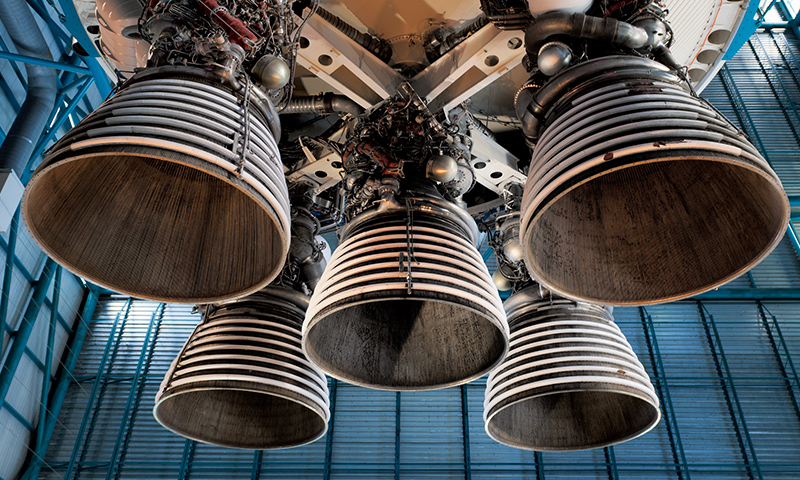

Space exploration

- Rocket purging

- Leak detection

Computing

- Data centres

- Quantum computing

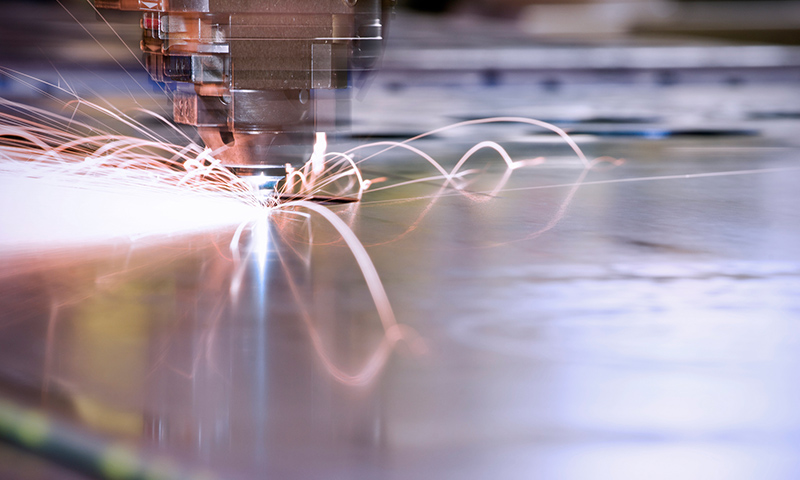

Industrial

- Welding

- Leak testing

Helium supply

The helium market has unique supply, demand and storage dynamics, leading to almost a continual increase in prices. Over the last decade, helium demand has flatlined (given lack of supply), against a backdrop of 30% global GDP growth. Rather than GDP-linked helium demand growth, as with most commodities, the price has had to go up each year instead. Over the last 20 years, helium pricing has increased at a CAGR of 8% reaching ~US$375/mcf in late 2022 – this is around 100x current US natural gas pricing (AKAP Energy, 2023).

With the worst of the helium shortage 4.0 seemingly behind us, the helium business is a classic oligopoly with four global shortages since 2006. Helium pricing is complex, with the price for large quantities at the source increasing by an estimated 11% per year from 2006-2022 (Kornbluth, 2023).

Demand by sector 2019

Source: Modified from Kornbluth Helium Consulting

Demand by sector 2021

Source: Modified from Kornbluth Helium Consulting

The current global market for bulk liquid helium is worth over US$2.8 billion with the import price to China now exceeding US$450 per thousand cubic feet (mcf) in 2022. Market growth is based on sustained demand growth driven by growing need for helium due to its high-value, high-tech uses.

There is an ongoing supply crisis of helium since the closure of the US federal reserve in 2019.

The majority of helium is sourced as a by-product of hydrocarbon production, with concentrations here typically 0.04-0.35%. As a low grade by-product it is not possible to increase current production to meet new demand, therefore current supply is inelastic to supply shocks.

A new source of high-grade primary helium is required to provide a flexible and responsive, low-cost, low-carbon sustainable source, not associated with hydrocarbons.